Sample tax return calculator

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Free 12 Sample Income Tax Calculator Templates In Pdf

Federal Taxes Withheld Through Your Paychecks Adoption Senior Taxes You Paid When You Filed an IRS Tax Extension for a 2021 Tax Year Return.

. File Income Taxes For Free. On 3000 capital gain at 15. Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator.

Discover Helpful Information And Resources On Taxes From AARP. This calculation does not include year-to-date totals. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Base on our sample computation if you are earning 25000month your taxable income would be 23400. Ad Plan Ahead For This Years Tax Return. This calculator is for the tax year 2022 which is payable in April of 2023.

Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status. This help guide will teach you how to use this tool. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016.

Based on your projected withholdings for the year we. 1040 Tax Estimation Calculator for 2022 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes. On this page Before you use the calculator Whats new for 202122 Information you need for this calculator When you cant use this calculator Access the calculator Before you use the calculator.

This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense Estimator Documents Checklist tool TaxCaster and more. See how income withholdings deductions and credits impact your tax refund or balance due. Credits child tax credit equal to 2000 per child 4000 Net tax.

Enter your filing status income deductions and credits and we will estimate your total taxes. It should not be used for any other purpose such as preparing a federal income tax return or to estimate anything other than your own personal tax liability. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Ad Free tax calculator for simple and complex returns. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Premium federal filing is 100 free with no upgrades. Need some help with the lingo. We offer calculators for 2016 2017 2018.

Calculate your tax refund for free. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000. Your household income location filing status and number of personal exemptions.

Guaranteed maximum tax refund. Enter your filing status income deductions and credits and we will estimate your total taxes. Individual - Sample personal income tax calculation Last reviewed - 01 August 2022.

Total tax before credits. This calculator will help you work out your tax refund or debt estimate. Skip To Main Content Last chance to save up to 30 ends February 28th when you finish and file.

It can be used for the 201516 to 202122 income years. TurboTax offers a free suite of tax calculators and tools to help save you money all year long. Launch tax calculator This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund.

You can use the Sample Tax Calculator to estimate an employees net pay. As a result they will increase your Tax Refund or reduce your Taxes Owed. Nearly all working Americans are required to file a tax return with the IRS each year and most pay taxes throughout the year in the form of payroll taxes that.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe. An administrator can use this tool for all employees and individual employees will have access to calculate their own tax information. On taxable income of 142600 145600 less capital gain of 3000 at joint-return rates.

Information and interactive calculators are made.

Tax Refund Estimator Calculator For 2021 Return In 2022

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Paycheck Calculator Online For Per Pay Period Create W 4

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free 12 Sample Income Tax Calculator Templates In Pdf

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

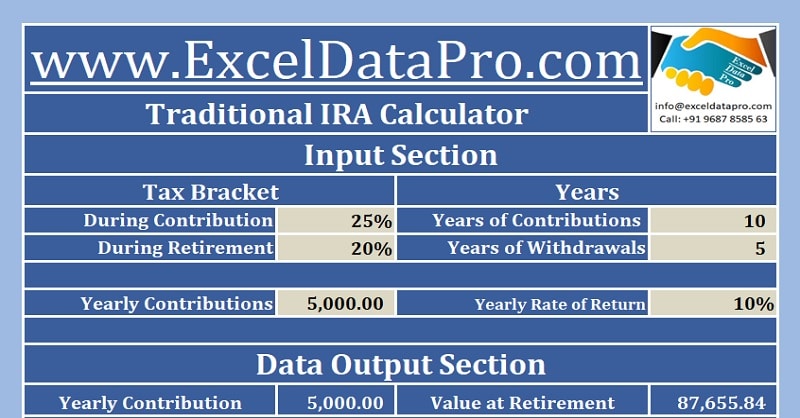

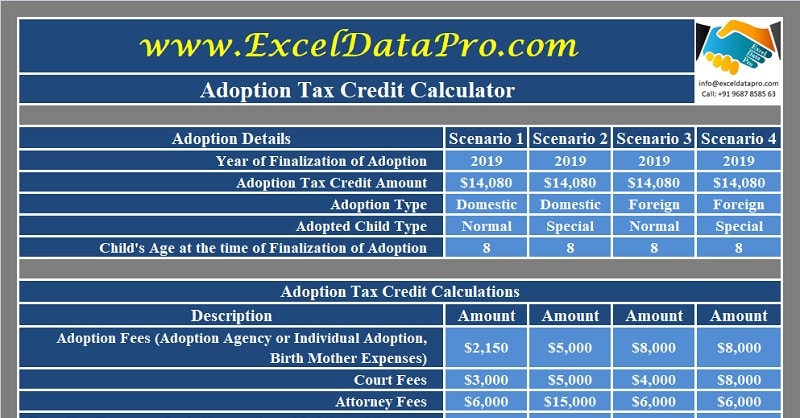

Download Free Federal Income Tax Templates In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Download Free Federal Income Tax Templates In Excel

Free 12 Sample Income Tax Calculator Templates In Pdf